Trading

Effective Risk Management Techniques for Forex Traders

In the world of forex trading, success isn’t just about spotting winning trades it’s about knowing how to manage risk. Without a solid plan in place, even the best traders can see their capital vanish. That’s why forex risk management is a critical skill every trader must master. Let’s explore how you can use smart […]

What is Effective Risk Management Techniques for Forex Traders?

In the world of forex trading, success isn’t just about spotting winning trades it’s about knowing how to manage risk. Without a solid plan in place, even the best traders can see their capital vanish. That’s why forex risk management is a critical skill every trader must master. Let’s explore how you can use smart strategies to protect your investments and increase your chances of long-term success.

Understanding Forex Risk

The forex market is known for its high liquidity and fast-paced action—but with these benefits come substantial risks. Some of the most common risks traders face include:

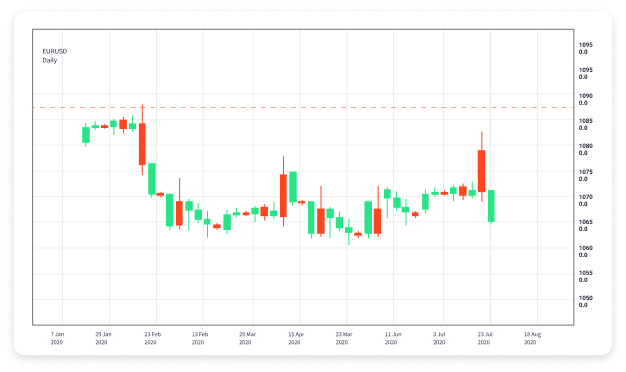

- High Volatility: Currency prices can change rapidly due to economic data, geopolitical events, or unexpected news.

- Leverage Risk: While leverage allows you to trade larger positions, it also magnifies potential losses.

- Market Gaps: Overnight price gaps can trigger stop-losses or widen spreads unexpectedly.

Understanding these factors is the first step in effective forex risk management. No matter how confident you are in your strategy, risk is always part of the game.

Key Forex Risk Management Techniques

Here are the most powerful trading risk strategies every forex trader should implement:

- Position Sizing

Before you even place a trade, calculate how much of your capital you’re willing to risk. A common rule is to risk only 1-2% of your account on a single trade. Position sizing helps you stay in the game longer—even if a few trades go against you.

- Stop-Loss Orders

This is your safety net. A stop-loss ensures your losses are capped if the market moves against you. Always place a stop-loss based on technical analysis or volatility—not emotion.

- Take-Profit Targets

Don’t just focus on minimizing losses—learn to lock in profits too. A take-profit level helps you exit trades at optimal points and avoid letting winning trades turn into losers.

- Risk-Reward Ratio

A good risk-reward ratio is at least 1:2—risking $100 to make $200. This way, even if only half of your trades win, you still come out ahead.

- Leverage Control

High leverage can be tempting, but it’s also dangerous. Start with low leverage until you’re confident with your strategy. At Bitrage Markets, you can adjust leverage settings to suit your trading goals.

Developing a Trading Risk Strategy

A solid risk management plan should be part of your overall trading strategy. Here’s how to build one:

- Set Clear Rules: Define your max risk per trade, target profit levels, and exit strategy.

- Stay Disciplined: Stick to your plan, even when emotions tempt you to chase losses.

- Review & Adapt: Use trade journals to track performance and adjust your strategies over time.

- Backtesting: Before going live, test your strategies using historical data to understand how they would perform under various market conditions.

Risk Management Tools on Bitrage Markets

When you trade with Bitrage Markets, you get access to professional-grade tools that make risk management easier:

- Built-in Stop-Loss/Take-Profit Settings

Set your limits directly within each trade for automatic execution. - Real-Time Alerts

Stay updated with market movements and price levels that matter to your strategy. - Margin & PnL Calculators

Quickly calculate risk, potential loss, and profit to stay in control. - Account Analytics Dashboard

Track your trading performance, win/loss ratio, and risk metrics in real-time.

With these features, you’ll have the confidence and control needed to minimize trading losses and trade smarter.

Conclusion

Successful forex traders don’t just focus on making profits—they focus on protecting their capital. By applying strong forex risk management techniques, setting disciplined rules, and using the tools available at Bitrage Markets, you can build a long-lasting trading career.

Remember: You can’t control the market—but you can always control your risk.